Washington, D.C. is one of the most expensive places to live in the country. Housing prices rose by 13.9 percent between the first quarter of last year and the first quarter of this year, the largest increase in the country compared to the U.S. average of 6 percent, according to the Urban Institute.

Experts say you shouldn’t spend more than 30 percent of your income on rent. But in the District, and parts of the United States, real estate prices and rent have risen so dramatically in recent years that most people pay closer to half of their income on housing.

“That’s unsustainable,” says Derek Hyra, an American University professor who focuses on Public Administration & Policy. Hyra wrote the book “Race, Class, and Politics in the Cappuccino City,” which examines the redevelopment of D.C.’s Shaw and U Street neighborhoods.

“You can only do that [devote so much income to paying rent] for so long before you don’t have enough money to pay for medical care. You don’t have enough money for food or shelter, for other things,” Hyra says.

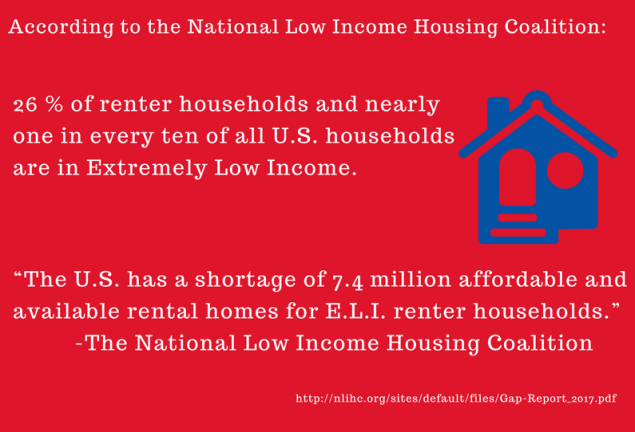

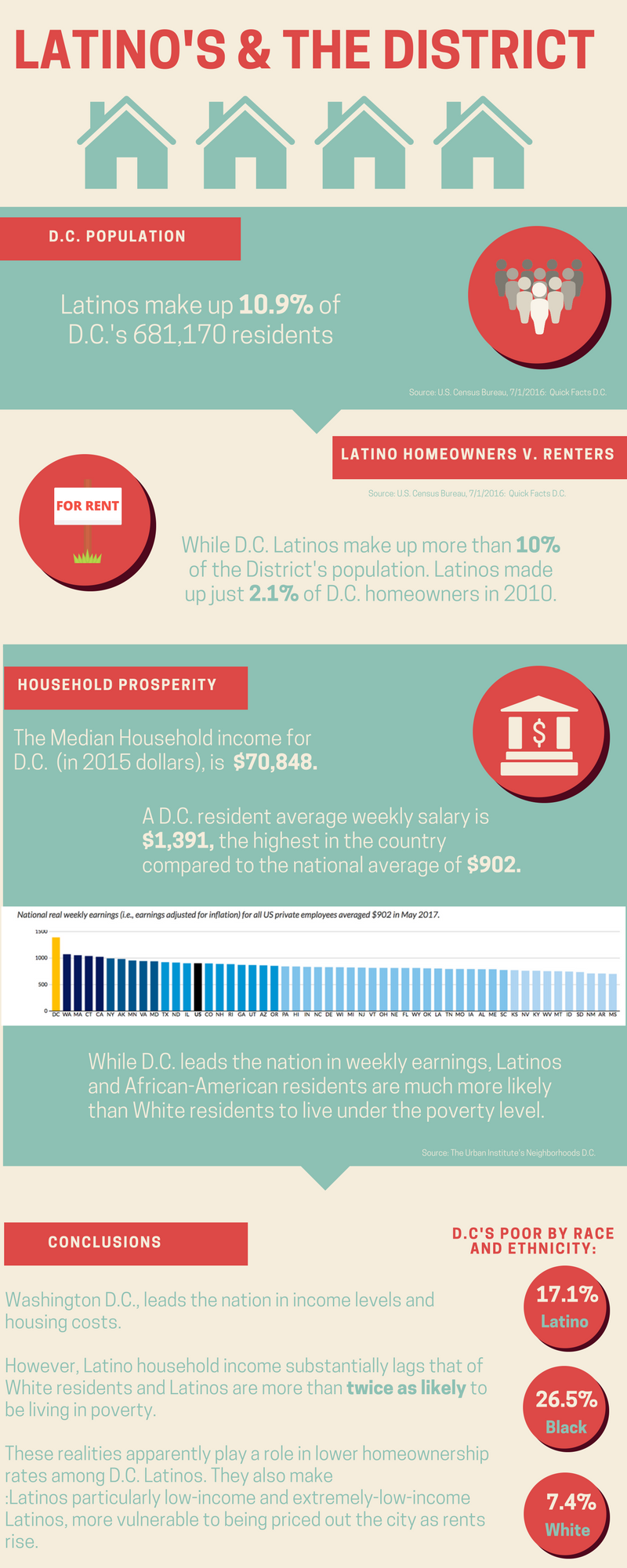

As housing costs rise, the District’s low-income renters are among the most vulnerable to homelessness or being forced to move out of the city. It’s a trend that has been unfurling in the District and many other U.S. cities for several years. It has led to a steady outflow of low-income residents, mostly African-Americans and Latinos, as city living has become more popular with younger people, particularly white professionals, who have moved into the city in large numbers.

“You kind of have this movement of minorities because you have an influx of whites coming into the central business district or to neighborhoods on the periphery of the central business district,” Hyra says. “That is leading to the movement out of low-income minorities, whether they’re Asian, Hispanic or African-American.”

The District has long been a majority-minority city but displacement due to high housing costs has disproportionately affected African-American, Latino and other minority residents who, according to U.S. Census data, are more likely to live under the poverty line than the city’s white residents.

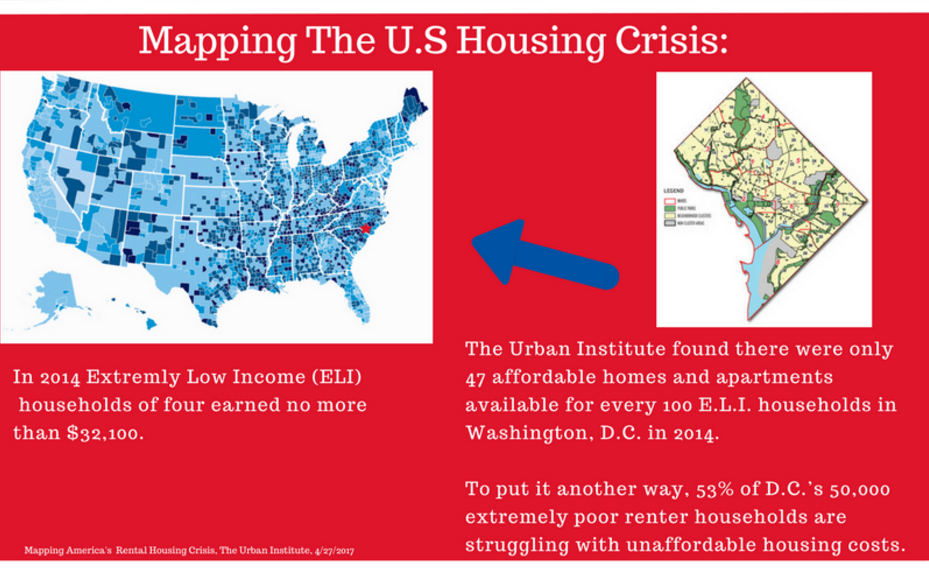

Demand for housing affordable by the D.C.’s poor residents, however, greatly outstrips supply. The Urban Institute found that 53% of the District’s 50,000 extremely low income residents are paying too much of their income in rent because of the shortage of affordable and available housing in the city.

The squeeze on low-income residents, particularly renters, is changing Washington, D.C., and its neighborhoods, according to Hyra and Michael Bader, a sociology professor at American University, who studies how neighborhoods have become less segregated since the passage of civil rights laws half a century ago. Bader says the growing popularity of city living among young and upwardly mobile professionals is transforming not just cities but suburban areas too.

“The most diverse places, in Metropolitan areas–this includes D.C.–are no longer in cities,” says Bader. “The most diverse places now are in suburbs.”

But Latinos, who move to Maryland and Virginia for the cheaper rent, often find that the government and social services they had come to rely on in the District are not available. While a few D.C. nonprofits such as the Latin American Youth Center and La Clínica del Pueblo have opened Maryland offices, many D.C. nonprofits serving Latinos remain located within the District only.

“The social safety net was designed to support the poor in central cities and urban poverty. In the last 20 years we’ve seen a large increase in the amount of suburban poverty but it’s been harder for nonprofits to move out to the suburbs due to the jurisdictions,” Bader says. “It’s harder because people aren’t as concentrated. It’s harder to design services in order to reach a lot of people very quickly.”

CONTINUE READING—NEXT TOPIC: Rent Control & the Latino community

READ MORE OF OUR UPDATED STORIES ON AFFORDABLE HOUSING AND RENT CONTROL

—Rebecca Toro